Trending...

- Where You Play Matters: MrBet Decodes Europe's Complex Gambling Tax Rules in New Report

- Who the Hell is Cloud9 Network—And Why Is Everyone Suddenly Watching?

- Newport Heights' Most Coveted Coastal Estate

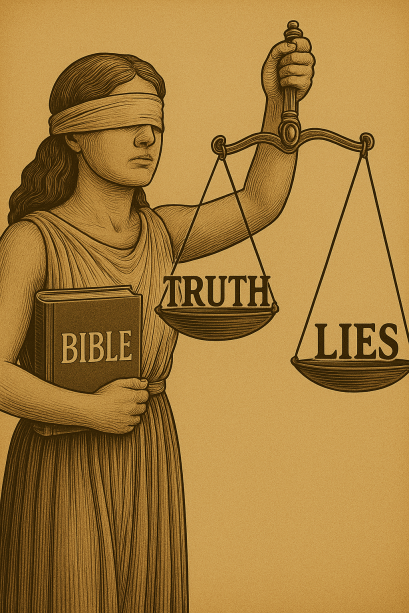

The truth needs to be told when billionaire hijacks true facts

LONDON - ncarol.com -- Date: August 13, 2025**

New York / London

⸻

MYTH vs. FACT: The Truth About the Astor Loan with Ricardo Salinas as told by Val Sklarov

New York — In light of recent public statements and speculation, Val Sklarov sets the record straight on the July 28, 2021 loan agreement with Ricardo Salinas Pliego and Astor Asset Management 3 Ltd ("Astor 3").

⸻

MYTH #1: That Astor 3 or Val Sklarov had stated that Val Sklarov or Astor 3 is descendant of Astor 3.

FACT: Astor 3 was formed in Canada at the request of Salinas. He had signed 2 identical loan agreements and had decided he wanted a Canadian based lender. He then requested that Astor 3 of Canada is formed as a Special Purpose Vehicle (SPV) just for him. Val Sklarov never said anything about any Astor family and this is pure fabrication and this is true fact.

⸻

MYTH #2: The shares pledged as collateral could not be rehypothecated.

FACT: The agreement granted unconditional rehypothecation rights. From day one, Astor 3 could rehypothecate, barter, pawn, charge, lend, re-pledge, transfer or lend the shares without further consent. That's how the loan contract is written and this is true fact.

⸻

MYTH #3: Salinas did not give a Power of Attorney (POA) over his pledge account.

FACT: False. Salinas had signed two documents titled Custodian Management Agreement (CMA) which is identical to a POA, giving Astor 3 unrestricted rights and control over the pledge account containing the securities and this is true fact.

⸻

MYTH #4: Rehypothecation was limited or restricted.

FACT: There were no restrictions. The rights were absolute, permanent, and acknowledged by Mr. Salinas in the contract he signed after his lawyers reviewed it and approved it. He allegedly has 300 lawyers working for him. Astor 3 had absolute Rehypothecation rights and this is true fact.

More on ncarol.com

⸻

MYTH #5: Salinas was unaware of his rights.

FACT: His legal team consisting of 300 lawyers reviewed, negotiated and approved all the loan documents. The rights were stated in plain language. The idea that he "didn't know" is not credible and this is true fact.

⸻

MYTH #6: All the interest and loan fees were paid for by Salinas according to contract terms.

FACT: Not true. Salinas paid interest only two times in 3 years and never paid other mandatory fees. As a banker, he should know to pay on time, but he didn't, being late 1 year the two times he paid and this is true fact.

⸻

MYTH #7: Default meant Salinas could still redeem the shares.

FACT: The agreement contained a waiver of redemption rights. Upon default, Astor 3 had zero obligation to return any collateral — it could liquidate immediately and retain all proceeds up to full repayment and this is true fact.

⸻

MYTH #8: The terms were one-sided or exploitative.

FACT: Both parties were sophisticated and represented by top legal counsel. Astor 3 bore significant risk, including market risk on volatile Elektra shares. Terms reflected that risk, as in any institutional securities-backed lending deal and this is true fact.

⸻

MYTH #9: The deal was secretive or unusual.

FACT: The structure was standard for institutional finance. The only "unusual" element was that Mr. Salinas personally requested a Canadian SPV be created for the transaction, after rejecting earlier U.S. and St. Kitts SOV's for tax and jurisdiction reasons and this is true fact.

⸻

MYTH #10: The lender couldn't call for more collateral.

FACT: The agreement allowed margin calls if the market value of Elektra shares dropped, ensuring the loan-to-value ratio stayed within agreed limits and this is true fact.

⸻

MYTH #11: That Salinas complied with all the terms of the loan.

FACT: Salinas had failed to comply with many provisions of the loan. He refuses to address the 20 breaches of the loan agreement and keeps making reference to Astor family in order to detract from the contract breaches and this is true fact.

More on ncarol.com

⸻

MYTH #12: The contract lacked legal safeguards for the lender.

FACT: It contained multiple waivers — fiduciary duty, unjust enrichment, implied covenant, and broad limitation of liability — plus a balance of equities clause favoring the lender in any dispute and this is true fact.

⸻

MYTH #13: The deal was somehow not binding.

FACT: The loan was valid, binding, and enforceable from the moment it was signed. It complied fully with UK law governing pledge of collateral in a loan and this is true fact.

⸻

MYTH #14: Salinas is owed money because Astor 3 did not fund in full.

FACT: Salinas has been funded in full, the sum of US $110 million and does not allege to be owed any money and this is true fact.

⸻

MYTH #15: Salinas wants his collateral back.

FACT: Salinas has already used the loan proceeds and had repurchased all the pledged shares back for less than the loan amount. Salina's repurchased all the shares for approximately US $68 million, while the loan was for US $110 million. Effectively, Salinas made a profit of US $42 million and this is true fact.

⸻

MYTH #16: Salinas believed he was dealing with the famous Astor family.

FACT: Neither Val Sklarov, nor Astor 3 has ever spoken to Salinas. What he believed is a figment of his imagination fed to Salinas by his own trusted agents and this is true fact.

⸻

MYTH #17: Salinas does not know why he defaulted.

FACT: Salinas has been sent 8 Amended Notices of Default. He refuses to respond to them and this is true fact.

⸻

MYTH #18: Lawyers representing Salinas have always told the truth.

FACT: Unfortunately, that's not the case. Salinas lawyers have been fabricating events at the instruction of Salinas and this is true fact. The misrepresentations made by Salinas lawyers to UK court have caused us to repeatedly resort to media to deliver the truth and this is true fact.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family and I never met or spoken to Salinas. Any claim otherwise is fiction."

⸻

New York / London

⸻

MYTH vs. FACT: The Truth About the Astor Loan with Ricardo Salinas as told by Val Sklarov

New York — In light of recent public statements and speculation, Val Sklarov sets the record straight on the July 28, 2021 loan agreement with Ricardo Salinas Pliego and Astor Asset Management 3 Ltd ("Astor 3").

⸻

MYTH #1: That Astor 3 or Val Sklarov had stated that Val Sklarov or Astor 3 is descendant of Astor 3.

FACT: Astor 3 was formed in Canada at the request of Salinas. He had signed 2 identical loan agreements and had decided he wanted a Canadian based lender. He then requested that Astor 3 of Canada is formed as a Special Purpose Vehicle (SPV) just for him. Val Sklarov never said anything about any Astor family and this is pure fabrication and this is true fact.

⸻

MYTH #2: The shares pledged as collateral could not be rehypothecated.

FACT: The agreement granted unconditional rehypothecation rights. From day one, Astor 3 could rehypothecate, barter, pawn, charge, lend, re-pledge, transfer or lend the shares without further consent. That's how the loan contract is written and this is true fact.

⸻

MYTH #3: Salinas did not give a Power of Attorney (POA) over his pledge account.

FACT: False. Salinas had signed two documents titled Custodian Management Agreement (CMA) which is identical to a POA, giving Astor 3 unrestricted rights and control over the pledge account containing the securities and this is true fact.

⸻

MYTH #4: Rehypothecation was limited or restricted.

FACT: There were no restrictions. The rights were absolute, permanent, and acknowledged by Mr. Salinas in the contract he signed after his lawyers reviewed it and approved it. He allegedly has 300 lawyers working for him. Astor 3 had absolute Rehypothecation rights and this is true fact.

More on ncarol.com

- 3,000+ Business Owners Create Tasks in One Click and Plan Their Day in Seconds: Voiset App Gets Major Speed Upgrade

- $100 Million Raise Initiative Launched via Share Offering at $4 Level for Cryptocurrency and Real Estate Development Project Company: OFA Group $OFAL

- Author Lorilyn Roberts Explores Humanity's Origins in New YA Sci-Fi Thriller, The Eighth Dimension: Frequency

- Dr. Samuel Waymon to represent the USA and the legacy of Nina Simone in Barbados at CARIFESTA XV

- This Sunday on "Financial Freedom with Tom Hegna" Larry and Judy Poole

⸻

MYTH #5: Salinas was unaware of his rights.

FACT: His legal team consisting of 300 lawyers reviewed, negotiated and approved all the loan documents. The rights were stated in plain language. The idea that he "didn't know" is not credible and this is true fact.

⸻

MYTH #6: All the interest and loan fees were paid for by Salinas according to contract terms.

FACT: Not true. Salinas paid interest only two times in 3 years and never paid other mandatory fees. As a banker, he should know to pay on time, but he didn't, being late 1 year the two times he paid and this is true fact.

⸻

MYTH #7: Default meant Salinas could still redeem the shares.

FACT: The agreement contained a waiver of redemption rights. Upon default, Astor 3 had zero obligation to return any collateral — it could liquidate immediately and retain all proceeds up to full repayment and this is true fact.

⸻

MYTH #8: The terms were one-sided or exploitative.

FACT: Both parties were sophisticated and represented by top legal counsel. Astor 3 bore significant risk, including market risk on volatile Elektra shares. Terms reflected that risk, as in any institutional securities-backed lending deal and this is true fact.

⸻

MYTH #9: The deal was secretive or unusual.

FACT: The structure was standard for institutional finance. The only "unusual" element was that Mr. Salinas personally requested a Canadian SPV be created for the transaction, after rejecting earlier U.S. and St. Kitts SOV's for tax and jurisdiction reasons and this is true fact.

⸻

MYTH #10: The lender couldn't call for more collateral.

FACT: The agreement allowed margin calls if the market value of Elektra shares dropped, ensuring the loan-to-value ratio stayed within agreed limits and this is true fact.

⸻

MYTH #11: That Salinas complied with all the terms of the loan.

FACT: Salinas had failed to comply with many provisions of the loan. He refuses to address the 20 breaches of the loan agreement and keeps making reference to Astor family in order to detract from the contract breaches and this is true fact.

More on ncarol.com

- Larry & Judy Poole Join Tom Hegna on "Financial Freedom with Tom Hegna"

- EZsolutions Launches EZ AI with Proprietary AI Test Matrix to Revolutionize AI Search Optimization for Local Businesses

- Dr. Mark Dill Expands Dental Technology Suite in Cleveland, TN with 3D Printing and Panoramic Imaging

- Assent's New EU Deforestation Regulation Solution Helps Manufacturers Ensure Readiness for Urgent Deadline

- Grayslake Police & Fire Face Off Against "Beat Bob" in Charity Volleyball Showdown – Sept 13th, 2025

⸻

MYTH #12: The contract lacked legal safeguards for the lender.

FACT: It contained multiple waivers — fiduciary duty, unjust enrichment, implied covenant, and broad limitation of liability — plus a balance of equities clause favoring the lender in any dispute and this is true fact.

⸻

MYTH #13: The deal was somehow not binding.

FACT: The loan was valid, binding, and enforceable from the moment it was signed. It complied fully with UK law governing pledge of collateral in a loan and this is true fact.

⸻

MYTH #14: Salinas is owed money because Astor 3 did not fund in full.

FACT: Salinas has been funded in full, the sum of US $110 million and does not allege to be owed any money and this is true fact.

⸻

MYTH #15: Salinas wants his collateral back.

FACT: Salinas has already used the loan proceeds and had repurchased all the pledged shares back for less than the loan amount. Salina's repurchased all the shares for approximately US $68 million, while the loan was for US $110 million. Effectively, Salinas made a profit of US $42 million and this is true fact.

⸻

MYTH #16: Salinas believed he was dealing with the famous Astor family.

FACT: Neither Val Sklarov, nor Astor 3 has ever spoken to Salinas. What he believed is a figment of his imagination fed to Salinas by his own trusted agents and this is true fact.

⸻

MYTH #17: Salinas does not know why he defaulted.

FACT: Salinas has been sent 8 Amended Notices of Default. He refuses to respond to them and this is true fact.

⸻

MYTH #18: Lawyers representing Salinas have always told the truth.

FACT: Unfortunately, that's not the case. Salinas lawyers have been fabricating events at the instruction of Salinas and this is true fact. The misrepresentations made by Salinas lawyers to UK court have caused us to repeatedly resort to media to deliver the truth and this is true fact.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family and I never met or spoken to Salinas. Any claim otherwise is fiction."

⸻

Source: Astor Asset Management 3 Ltd

Filed Under: Business

0 Comments

Latest on ncarol.com

- Genpak Increases Foodservice Packaging Efficiency for Emerging Restaurants

- Where You Play Matters: MrBet Decodes Europe's Complex Gambling Tax Rules in New Report

- $1 Million Equity Dividend Ignites Investor Frenzy as AI & Cybersecurity Titans IQSTEL (N A S D A Q: IQST) & Cycurion (N A S D A Q: CYCU) Join Forces

- From Paris to Rome to Venice — The World's No.1 Superstar™ Claims Another City with Bad Boy's Wild Ride

- Digital Dawn Launches Revolutionary Bitcoin Copy Trading Platform With 30-40% Monthly Returns

- Letter Four Launches Design-Build Decoded™ Podcast: Demystifying Architecture and Construction with AI Hosts

- Magnificent 63-Acre Equestrian Estate in Maryland's Horse Country Lists for $5.75M

- Shaping the Future of Congresses and Conventions: Osvaldo Rivera's Double Win at LAWA 2025

- Louisiana's First Dedicated Residential Eating Disorder Treatment Center for Women Opens Near New Orleans

- Post-Traditional Career Expert Sandra Buatti-Ramos Receives 2025 Top Career Coach Recognition

- CCHR Calls for Audit of Forced Psychiatric Drugging and Systemic Misdiagnosis

- St. Paul, Mn Goes Ninja: Emmy-winning Naruto Star Maile Flanagan Headlines Inaugural Anime Wonder Fest

- Local Author Heather Barbour Fenty Releases Third Book in Beloved "Sea Series"

- FDA Fast Track Designation for $3 Billion Suicidal Depression Market May Soon be Accessible for Effective NRX 100 Drug Therapy: NRx Pharmaceuticals

- Slotozilla Expands Partner Network With 25+ Affiliates and Unveils 139 New Bonuses in Q2 2025

- Who the Hell is Cloud9 Network—And Why Is Everyone Suddenly Watching?

- Newport Heights' Most Coveted Coastal Estate

- A Quality 4.0 roadmap is now available!

- Bay Miner Unveils Crypto Mining App to Help Investors Seize 2025's XRP Compliance Investment Opportunities

- Arms Preservation Inc Offers Industry-Leading VCI Firearm Storage Bags for Superior Rust Prevention