Trending...

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

Innovative liquid leak detection provider for commercial and industrial buildings and equipment raises funds to further expand coverage in North America.

ncarol.com -- LAIIER, an innovative liquid leak detection solution provider for commercial and industrial buildings, announced today that it has raised US$4M in seed extension funding. Closed Loop Partners' Ventures Group, the venture capital arm of the circular economy-focused firm, led the financing round, with participation from six other funds.

Existing investors Burnt Island Ventures and Mundi Ventures participated in the round, and were joined by new investors Bonaventure Capital, Carlisle Ventures, One Small Planet, and Virta Ventures.

LAIIER focuses on solving the $19B+ annual problem of damage and downtime caused by liquid leaks in commercial buildings and industrial equipment. Traditional leak detection methods are inefficient, relying on manual inspections and resulting in slow response times of over 80 hours. This leads to significant financial losses, with properties experiencing between one and four large leak events annually. The severity of these leaks can vary widely, with costs escalating rapidly for severe cases and risks of expensive insurance claims and water loss increasing.

As real estate owner operators continue to seek more reliable leak detection that has a positive impact on both financial and environmental metrics, LAIIER's technology offers scale, precision, and ROI that few other solutions on the market can match.

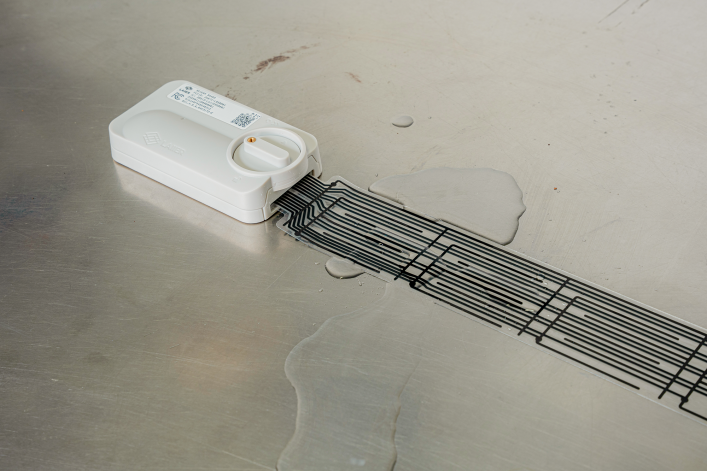

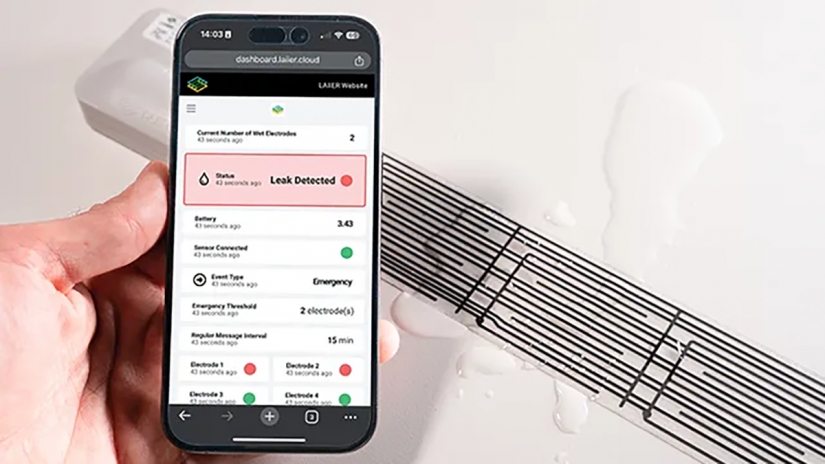

First launched in 2022, the company's flagship water leak detection product, Severn WLD™, is currently protecting assets in a range of commercial and industrial buildings in North America and Europe, including those of Fortune 500 and FTSE 100 companies. The technology detects as little as two drops of water, offers flexible installation, precise sensitivity control, and utilizes long-range, low-power communication.

These advanced sensors, and the company's cloud platform, LAIIER Cloud™, enable early detection of leaks and real-time monitoring, contributing to substantial water savings by alerting customers to issues before they escalate. By identifying leaks in their initial stages, LAIIER's technology plays a crucial role in preventing extensive water damage to buildings and equipment, and helps mitigate the loss of water––an increasingly scarce and valuable commodity.

More on ncarol.com

"This funding round represents a pivotal moment for LAIIER as we continue to accelerate our growth across North America and Europe," said Matt Johnson, CEO & Co-founder of LAIIER. "Closed Loop Partners' Ventures Group is renowned for its leadership in sustainable innovation and its deep expertise in scaling transformative technologies. Their prestigious reputation and proven track record in advancing successful businesses align perfectly with our mission to redefine leak detection in industrial and commercial markets. We are honored to have their support and partnership."

The primary focus of the funding is to support the acceleration of LAIIER's commercial growth globally, with a particular focus on North American expansion. The funds will also support the company's continued investment in the development of its patented liquid leak detection technologies––both the commercially available water leak detection product, Severn WLD™; and the development of further liquid leak detection products for specific commercial and industrial applications.

"In an escalating climate crisis marked by increasing water scarcity and frequency of extreme weather events––from fires to flooding––solutions like LAIIER's drive awareness and action around our relationship with water and industrial lubricants, and represent a crucial step toward less damage and a better experience with insurers when damages occur. LAIIER's technology not only minimizes the risk of significant financial losses for asset owners, it can also prevent minor leaks from developing into major events, potentially conserving millions of gallons annually," said Aly Bryan, Investor on Closed Loop Partners' Ventures Group team. "We are proud to support LAIIER's continued growth in North America, and look forward to working with their team to advance circularity across industrial applications and in the built world at scale."

About LAIIER

LAIIER solves the $19B+ annual problem of damage and downtime caused by liquid leaks in commercial buildings and industrial equipment. The company's patented technologies deploy digital intelligence to detect and alert customers to leaking water, hydrocarbons, and more. Customers subscribe to the full-stack solution, which includes a unique sensor technology, connectivity and cloud services; providing a scale, precision, capability, and return on investment that competitors cannot match. LAIIER's technologies are deployed with insurers, real estate owner operators, and system integrators in North America and Europe.

About the Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The firm is comprised of three key businesses that create a platform for systems change: an investment group managing venture capital, buyout private equity and catalytic private credit investment strategies, Closed Loop Capital Management; an innovation center, the Center for the Circular Economy; and an operating group, Closed Loop Builders.

More on ncarol.com

The firm's venture capital strategy, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough circular solutions for foundational materials that underpin and significantly influence a wide array of vital sectors of the economy. These materials include organics, minerals, polymers and water. Closed Loop Ventures Group partners with founders and companies who rethink how products are designed, manufactured, consumed and recovered, with the shared vision of reimagining supply chains and eliminating waste. Closed Loop Partners is based in New York City and is a registered B Corp.

To learn about the Closed Loop Ventures Group and apply for funding, visit www.closedlooppartners.com.

Disclosures

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management's views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Executive endorsements of Closed Loop Capital Management are for illustrative purposes, designed to attract business development contacts, and should not be construed as a client or investor testimonial of Closed Loop Capital Management's investment advisory services. All such endorsements are from current or former portfolio company leadership about Closed Loop Capital Management's ability to provide services to their companies. Closed Loop Capital Management has not, directly or indirectly, paid any compensation to such individuals for their endorsements.

The Case Studies described on the Website are included as representative transactions to demonstrate assets to which Closed Loop Capital Management provides capital, however, are not representative of all Closed Loop Capital Management investments and are not necessarily reflective of overall results of any of Closed Loop Capital Management's businesses. Investments in other businesses may have materially different results. Not all Closed Loop Capital Management investments had or will have similar characteristics or experiences as those included herein.

Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words "believe", "expect", "anticipate", "optimistic", "intend", "aim", "will" or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Existing investors Burnt Island Ventures and Mundi Ventures participated in the round, and were joined by new investors Bonaventure Capital, Carlisle Ventures, One Small Planet, and Virta Ventures.

LAIIER focuses on solving the $19B+ annual problem of damage and downtime caused by liquid leaks in commercial buildings and industrial equipment. Traditional leak detection methods are inefficient, relying on manual inspections and resulting in slow response times of over 80 hours. This leads to significant financial losses, with properties experiencing between one and four large leak events annually. The severity of these leaks can vary widely, with costs escalating rapidly for severe cases and risks of expensive insurance claims and water loss increasing.

As real estate owner operators continue to seek more reliable leak detection that has a positive impact on both financial and environmental metrics, LAIIER's technology offers scale, precision, and ROI that few other solutions on the market can match.

First launched in 2022, the company's flagship water leak detection product, Severn WLD™, is currently protecting assets in a range of commercial and industrial buildings in North America and Europe, including those of Fortune 500 and FTSE 100 companies. The technology detects as little as two drops of water, offers flexible installation, precise sensitivity control, and utilizes long-range, low-power communication.

These advanced sensors, and the company's cloud platform, LAIIER Cloud™, enable early detection of leaks and real-time monitoring, contributing to substantial water savings by alerting customers to issues before they escalate. By identifying leaks in their initial stages, LAIIER's technology plays a crucial role in preventing extensive water damage to buildings and equipment, and helps mitigate the loss of water––an increasingly scarce and valuable commodity.

More on ncarol.com

- Peccioli Becomes New Orleans: In July 2026, the magic of jazz comes to Tuscany

- Luxur Tequila Introduces a New Standard of Luxury Spirits with Customizable Bottles & Visionary Lea

- Pepper Moon Catering Awarded Five-Year Single-Award BPA with NC Army National Guard (NC-ARNG)

- Local Eco-Friendly Cleaning Company Expands Services to Cary, Apex, and Morrisville

- $6 Million Funding Secured as Retail Expansion, Operational Streamlining, and Asset-Light Strategy Position the Company for Accelerated Growth $SOWG

"This funding round represents a pivotal moment for LAIIER as we continue to accelerate our growth across North America and Europe," said Matt Johnson, CEO & Co-founder of LAIIER. "Closed Loop Partners' Ventures Group is renowned for its leadership in sustainable innovation and its deep expertise in scaling transformative technologies. Their prestigious reputation and proven track record in advancing successful businesses align perfectly with our mission to redefine leak detection in industrial and commercial markets. We are honored to have their support and partnership."

The primary focus of the funding is to support the acceleration of LAIIER's commercial growth globally, with a particular focus on North American expansion. The funds will also support the company's continued investment in the development of its patented liquid leak detection technologies––both the commercially available water leak detection product, Severn WLD™; and the development of further liquid leak detection products for specific commercial and industrial applications.

"In an escalating climate crisis marked by increasing water scarcity and frequency of extreme weather events––from fires to flooding––solutions like LAIIER's drive awareness and action around our relationship with water and industrial lubricants, and represent a crucial step toward less damage and a better experience with insurers when damages occur. LAIIER's technology not only minimizes the risk of significant financial losses for asset owners, it can also prevent minor leaks from developing into major events, potentially conserving millions of gallons annually," said Aly Bryan, Investor on Closed Loop Partners' Ventures Group team. "We are proud to support LAIIER's continued growth in North America, and look forward to working with their team to advance circularity across industrial applications and in the built world at scale."

About LAIIER

LAIIER solves the $19B+ annual problem of damage and downtime caused by liquid leaks in commercial buildings and industrial equipment. The company's patented technologies deploy digital intelligence to detect and alert customers to leaking water, hydrocarbons, and more. Customers subscribe to the full-stack solution, which includes a unique sensor technology, connectivity and cloud services; providing a scale, precision, capability, and return on investment that competitors cannot match. LAIIER's technologies are deployed with insurers, real estate owner operators, and system integrators in North America and Europe.

About the Closed Loop Ventures Group at Closed Loop Partners

Closed Loop Partners is at the forefront of building the circular economy. The firm is comprised of three key businesses that create a platform for systems change: an investment group managing venture capital, buyout private equity and catalytic private credit investment strategies, Closed Loop Capital Management; an innovation center, the Center for the Circular Economy; and an operating group, Closed Loop Builders.

More on ncarol.com

- The "Unsexy" Business Quietly Creating 130+ New Entrepreneurs Across America — From Alaska to Puerto Rico

- Veteran Launches GTG Energy: Nicotine-Free Pouch as Americans Rethink Addiction, Focus, and What Fuels Performance

- Global Window Covering Industry Pros and Designers Head to Raleigh for Major Trade-Only Expo

- RecallSentry™ App Launch — Your Home Safety Hub — Free on iOS & Android

- Award-Winning Director Crystal J. Huang's Under-$50K Film "The Ritual House" Wins Best Horror Feature at Golden State Film Festival

The firm's venture capital strategy, the Closed Loop Ventures Group, has been investing early-stage capital into companies developing breakthrough circular solutions for foundational materials that underpin and significantly influence a wide array of vital sectors of the economy. These materials include organics, minerals, polymers and water. Closed Loop Ventures Group partners with founders and companies who rethink how products are designed, manufactured, consumed and recovered, with the shared vision of reimagining supply chains and eliminating waste. Closed Loop Partners is based in New York City and is a registered B Corp.

To learn about the Closed Loop Ventures Group and apply for funding, visit www.closedlooppartners.com.

Disclosures

This publication is for informational purposes only, and nothing contained herein constitutes an offer to sell or a solicitation of an offer to buy any interest in any investment vehicle managed by Closed Loop Capital Management or any company in which Closed Loop Capital Management or its affiliates have invested. An offer or solicitation will be made only through a final private placement memorandum, subscription agreement and other related documents with respect to a particular investment opportunity and will be subject to the terms and conditions contained in such documents, including the qualifications necessary to become an investor. Closed Loop Capital Management does not utilize its website to provide investment or other advice, and nothing contained herein constitutes a comprehensive or complete statement of the matters discussed or the law relating thereto. Information provided reflects Closed Loop Capital Management's views as of a particular time and are subject to change without notice. You should obtain relevant and specific professional advice before making any investment decision.

Executive endorsements of Closed Loop Capital Management are for illustrative purposes, designed to attract business development contacts, and should not be construed as a client or investor testimonial of Closed Loop Capital Management's investment advisory services. All such endorsements are from current or former portfolio company leadership about Closed Loop Capital Management's ability to provide services to their companies. Closed Loop Capital Management has not, directly or indirectly, paid any compensation to such individuals for their endorsements.

The Case Studies described on the Website are included as representative transactions to demonstrate assets to which Closed Loop Capital Management provides capital, however, are not representative of all Closed Loop Capital Management investments and are not necessarily reflective of overall results of any of Closed Loop Capital Management's businesses. Investments in other businesses may have materially different results. Not all Closed Loop Capital Management investments had or will have similar characteristics or experiences as those included herein.

Certain information on this Website may contain forward-looking statements, which are subject to risks and uncertainties and speak only as of the date on which they are made. The words "believe", "expect", "anticipate", "optimistic", "intend", "aim", "will" or similar expressions are intended to identify forward-looking statements. Closed Loop Capital Management undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. Past performance is not indicative of future results; no representation is being made that any investment or transaction will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided.

Source: LAIIER

0 Comments

Latest on ncarol.com

- Matthew Sisneros Releases Raw and Unfiltered Memoir: The Devil Lost Another One — A Powerful Story of Crime, Consequence, and Redemption

- From Life to Light: Jess L. Martinez Shares a Soulful Poetry Collection That Explores What It Means to Be Human

- Lawsuit Filed Against Boeing Over Defective Seat Switch on Boeing 787

- Quadcode Acquires Significant Stake in Game 7, LLC - The Parent Company for FPFX Tech and PropAccount.com

- Danholm Collection Announces Sale of 16689 Broadwater Ave in Winter Garden, Highlighting Strong Performance in Twinwaters Community

- Cleveland County Families Choosing to Restore Quality Furniture Instead of Buying New

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Emperor of the Cherokee: A Novel Debuts

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Legendary broadcaster & cultural influencer Beatrice Thompson sat down with hosts of The Game Has E

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida