Trending...

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

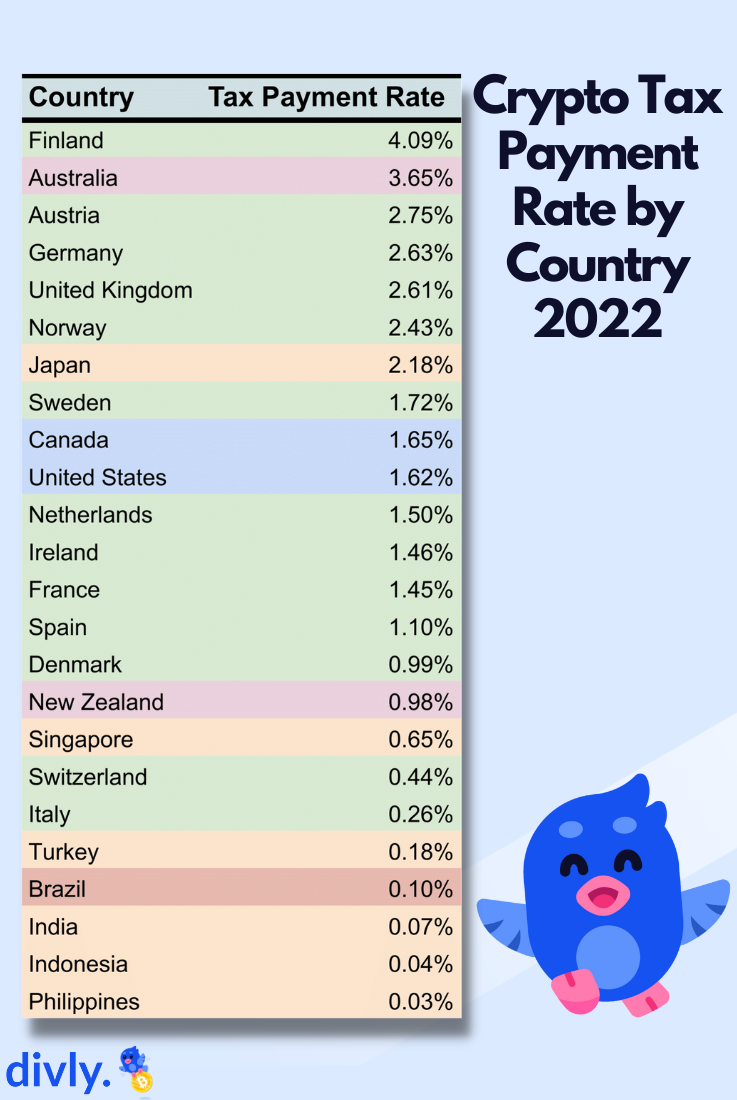

STOCKHOLM - ncarol.com -- A study by European cryptocurrency tax calculator Divly estimated that just 0.53% of cryptocurrency investors declared their cryptocurrency activity to their local tax authorities in 2022. However, tax payment rates varied significantly by country, with Finland boasting the highest rate at 4.09% and the Philippines registering the lowest at 0.03%.

In the United States, an estimated 1.62% of cryptocurrency investors declared their crypto holdings to tax authorities in 2022, placing the US 10th among the 24 countries analyzed. Other countries with relatively high tax payment rates included Australia (3.65%), Austria (2.75%), Germany (2.63%), and the United Kingdom (2.61%).

The study looked at the total number of cryptocurrency investors that declared their taxes but does not claim that everyone who invested in cryptocurrency was required to pay taxes.

Historical Trends in Cryptocurrency Tax Compliance

More on ncarol.com

Historical trends show a steady increase in cryptocurrency tax declarations. In 2015, less than 900 US citizens reported crypto according to the United States District Court, while 5.9 million Coinbase accounts were active. By 2018, declaration rates increased to 0.8% based on data from Credit Karma. The current study estimates 1.62% of US investors declared taxes in 2022, a doubling since 2018, but compliance remains low.

Discrepancies with Survey-Based Studies

While this study presents a comprehensive analysis of global cryptocurrency tax compliance, it is worth noting that its findings differ from those of several survey-based studies. These discrepancies may be attributed to differences in methodology and potential biases in survey data.

Survey-Based Studies in the US

Cointracker conducted a survey in 2022 that showed 4% of US cryptocurrency investors had reported their cryptocurrencies at a time when 40% of individual returns had been filed. This figure is considerably higher than the 1.62% estimated by the current study. Similarly, a Coinledger survey in 2021 indicated that more than 50% of respondents declared their crypto holdings on their tax returns.

More on ncarol.com

Factors identified that may contribute to discrepancies in compliance rates between the study and previous surveys include potential overestimation due to respondents' unwillingness to admit non-compliance, and self-selection bias, which results in skewed data from differing participant choices.

Future Outlook

Tax payment rates for cryptocurrencies may improve as countries implement new regulations and enhance enforcement, such as the European Union's proposed changes to the Directive on Administrative Cooperation (DAC).

The report highlights the current state of cryptocurrency tax compliance across the globe and underscores the need for improved regulation and enforcement. As the cryptocurrency landscape continues to evolve, it will be crucial for governments and tax authorities to adapt and ensure that the growing number of investors are adequately informed about their tax obligations.

In the United States, an estimated 1.62% of cryptocurrency investors declared their crypto holdings to tax authorities in 2022, placing the US 10th among the 24 countries analyzed. Other countries with relatively high tax payment rates included Australia (3.65%), Austria (2.75%), Germany (2.63%), and the United Kingdom (2.61%).

The study looked at the total number of cryptocurrency investors that declared their taxes but does not claim that everyone who invested in cryptocurrency was required to pay taxes.

Historical Trends in Cryptocurrency Tax Compliance

More on ncarol.com

- Cleveland County Families Choosing to Restore Quality Furniture Instead of Buying New

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

Historical trends show a steady increase in cryptocurrency tax declarations. In 2015, less than 900 US citizens reported crypto according to the United States District Court, while 5.9 million Coinbase accounts were active. By 2018, declaration rates increased to 0.8% based on data from Credit Karma. The current study estimates 1.62% of US investors declared taxes in 2022, a doubling since 2018, but compliance remains low.

Discrepancies with Survey-Based Studies

While this study presents a comprehensive analysis of global cryptocurrency tax compliance, it is worth noting that its findings differ from those of several survey-based studies. These discrepancies may be attributed to differences in methodology and potential biases in survey data.

Survey-Based Studies in the US

Cointracker conducted a survey in 2022 that showed 4% of US cryptocurrency investors had reported their cryptocurrencies at a time when 40% of individual returns had been filed. This figure is considerably higher than the 1.62% estimated by the current study. Similarly, a Coinledger survey in 2021 indicated that more than 50% of respondents declared their crypto holdings on their tax returns.

More on ncarol.com

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Emperor of the Cherokee: A Novel Debuts

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

Factors identified that may contribute to discrepancies in compliance rates between the study and previous surveys include potential overestimation due to respondents' unwillingness to admit non-compliance, and self-selection bias, which results in skewed data from differing participant choices.

Future Outlook

Tax payment rates for cryptocurrencies may improve as countries implement new regulations and enhance enforcement, such as the European Union's proposed changes to the Directive on Administrative Cooperation (DAC).

The report highlights the current state of cryptocurrency tax compliance across the globe and underscores the need for improved regulation and enforcement. As the cryptocurrency landscape continues to evolve, it will be crucial for governments and tax authorities to adapt and ensure that the growing number of investors are adequately informed about their tax obligations.

Source: Divly

Filed Under: Financial

0 Comments

Latest on ncarol.com

- Lighthouse Tech Awards Recognize Top HR Technology Providers for 2026

- ADB Selects OneVizion to Advance Field Execution and Infrastructure Program Management

- Memelinked Social Media powered by cryptocurrency launching July 2026

- DwellSafe and Bruno Partner to Bring Clinician-Backed Stairlift Education to Families

- Seven-Year-Old Toronto Dancer Julianna Selivanov Wins Nine Medals at Quebec Championship and Reaches Finals at UK Dance Festival

- Leoforce Releases Beyond Programmatic: A Practical Guide to Long-Term Hiring Outcomes

- Progressive Dental & The Closing Institute Partner with Zest Dental Solutions to Elevate Full-Arch Growth and Patient Outcomes

- Spring Surge in 55+ Communities: What Buyers and Sellers Need to Know in 2026

- Jason Caras Launches The Caras Institute Following Successful Exit from IT Authorities

- Serina Damesworth Hired as Century Fasteners Corp. – Director of Quality

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- Distributed Social Media - Own Your Content

- Tarrytown Expocare Pharmacy Announces Strategic Leadership Appointments to Accelerate Growth and Innovation

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

- Interview: Why I Sponsored Carson Ware - The Full Story

- March Is Skiing's Smartest Buying Window

- Zeo Health Introduces KidZ Cleanse with Folinic Acid

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

- Tobu Group's "T-home Series" of Accommodations in Tokyo Just Opened "T-home KEI."