Trending...

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

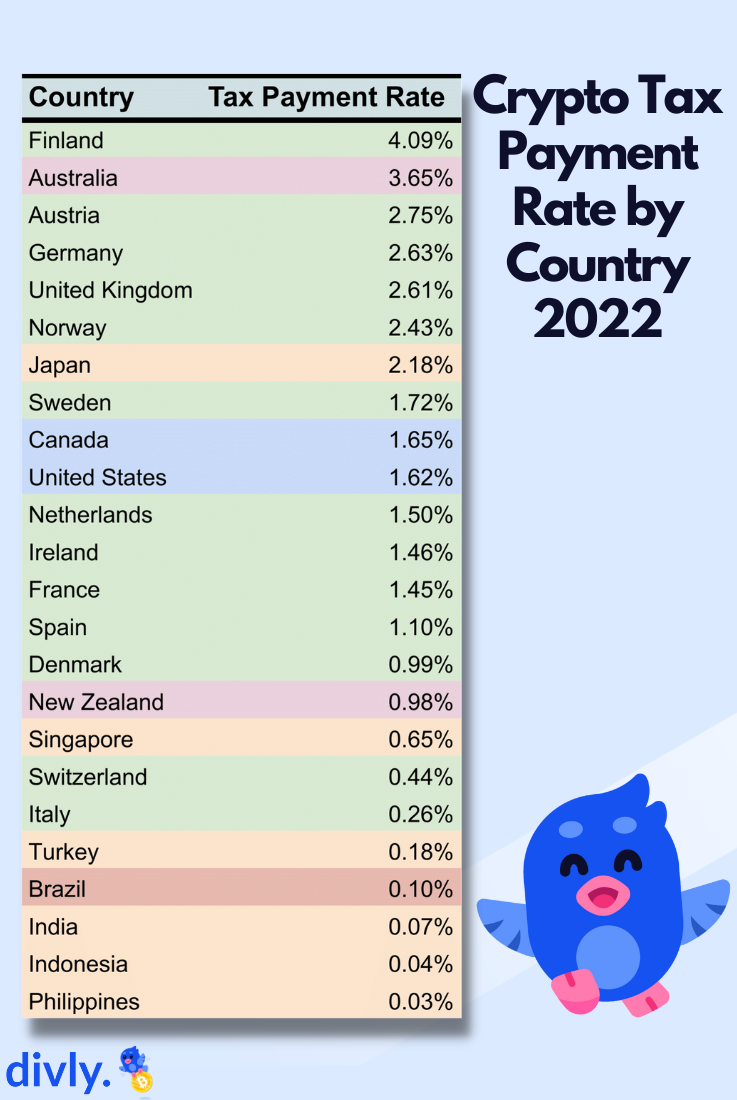

STOCKHOLM - ncarol.com -- A study by European cryptocurrency tax calculator Divly estimated that just 0.53% of cryptocurrency investors declared their cryptocurrency activity to their local tax authorities in 2022. However, tax payment rates varied significantly by country, with Finland boasting the highest rate at 4.09% and the Philippines registering the lowest at 0.03%.

In the United States, an estimated 1.62% of cryptocurrency investors declared their crypto holdings to tax authorities in 2022, placing the US 10th among the 24 countries analyzed. Other countries with relatively high tax payment rates included Australia (3.65%), Austria (2.75%), Germany (2.63%), and the United Kingdom (2.61%).

The study looked at the total number of cryptocurrency investors that declared their taxes but does not claim that everyone who invested in cryptocurrency was required to pay taxes.

Historical Trends in Cryptocurrency Tax Compliance

More on ncarol.com

Historical trends show a steady increase in cryptocurrency tax declarations. In 2015, less than 900 US citizens reported crypto according to the United States District Court, while 5.9 million Coinbase accounts were active. By 2018, declaration rates increased to 0.8% based on data from Credit Karma. The current study estimates 1.62% of US investors declared taxes in 2022, a doubling since 2018, but compliance remains low.

Discrepancies with Survey-Based Studies

While this study presents a comprehensive analysis of global cryptocurrency tax compliance, it is worth noting that its findings differ from those of several survey-based studies. These discrepancies may be attributed to differences in methodology and potential biases in survey data.

Survey-Based Studies in the US

Cointracker conducted a survey in 2022 that showed 4% of US cryptocurrency investors had reported their cryptocurrencies at a time when 40% of individual returns had been filed. This figure is considerably higher than the 1.62% estimated by the current study. Similarly, a Coinledger survey in 2021 indicated that more than 50% of respondents declared their crypto holdings on their tax returns.

More on ncarol.com

Factors identified that may contribute to discrepancies in compliance rates between the study and previous surveys include potential overestimation due to respondents' unwillingness to admit non-compliance, and self-selection bias, which results in skewed data from differing participant choices.

Future Outlook

Tax payment rates for cryptocurrencies may improve as countries implement new regulations and enhance enforcement, such as the European Union's proposed changes to the Directive on Administrative Cooperation (DAC).

The report highlights the current state of cryptocurrency tax compliance across the globe and underscores the need for improved regulation and enforcement. As the cryptocurrency landscape continues to evolve, it will be crucial for governments and tax authorities to adapt and ensure that the growing number of investors are adequately informed about their tax obligations.

In the United States, an estimated 1.62% of cryptocurrency investors declared their crypto holdings to tax authorities in 2022, placing the US 10th among the 24 countries analyzed. Other countries with relatively high tax payment rates included Australia (3.65%), Austria (2.75%), Germany (2.63%), and the United Kingdom (2.61%).

The study looked at the total number of cryptocurrency investors that declared their taxes but does not claim that everyone who invested in cryptocurrency was required to pay taxes.

Historical Trends in Cryptocurrency Tax Compliance

More on ncarol.com

- US Interest Rate Pivot: Hedge Funds Leverage Tickeron AI for 177% Annualized Return

- Pastor Saeed Abedini Releases THE TRUTH – Volume 1, A Deeply Personal Story of Faith, Struggle, and Redemption

- New Book Warring From the Standpoint of the Throne Room Calls Believers to Pray From Victory

- Craigory Dunn & Dre Barracks Release Gospel-Soul Collaboration The Soul Renaissance

- Why Screen-Fatigued Parents are Choosing the Human Bridge

Historical trends show a steady increase in cryptocurrency tax declarations. In 2015, less than 900 US citizens reported crypto according to the United States District Court, while 5.9 million Coinbase accounts were active. By 2018, declaration rates increased to 0.8% based on data from Credit Karma. The current study estimates 1.62% of US investors declared taxes in 2022, a doubling since 2018, but compliance remains low.

Discrepancies with Survey-Based Studies

While this study presents a comprehensive analysis of global cryptocurrency tax compliance, it is worth noting that its findings differ from those of several survey-based studies. These discrepancies may be attributed to differences in methodology and potential biases in survey data.

Survey-Based Studies in the US

Cointracker conducted a survey in 2022 that showed 4% of US cryptocurrency investors had reported their cryptocurrencies at a time when 40% of individual returns had been filed. This figure is considerably higher than the 1.62% estimated by the current study. Similarly, a Coinledger survey in 2021 indicated that more than 50% of respondents declared their crypto holdings on their tax returns.

More on ncarol.com

- Scotch Whisky Market Dislocation Creates Compelling Entry Opportunity for Long-Term Investors

- Peccioli Becomes New Orleans: In July 2026, the magic of jazz comes to Tuscany

- Luxur Tequila Introduces a New Standard of Luxury Spirits with Customizable Bottles & Visionary Lea

- Pepper Moon Catering Awarded Five-Year Single-Award BPA with NC Army National Guard (NC-ARNG)

- Local Eco-Friendly Cleaning Company Expands Services to Cary, Apex, and Morrisville

Factors identified that may contribute to discrepancies in compliance rates between the study and previous surveys include potential overestimation due to respondents' unwillingness to admit non-compliance, and self-selection bias, which results in skewed data from differing participant choices.

Future Outlook

Tax payment rates for cryptocurrencies may improve as countries implement new regulations and enhance enforcement, such as the European Union's proposed changes to the Directive on Administrative Cooperation (DAC).

The report highlights the current state of cryptocurrency tax compliance across the globe and underscores the need for improved regulation and enforcement. As the cryptocurrency landscape continues to evolve, it will be crucial for governments and tax authorities to adapt and ensure that the growing number of investors are adequately informed about their tax obligations.

Source: Divly

Filed Under: Financial

0 Comments

Latest on ncarol.com

- CCHR: CIA Mind-Control Files Raise Urgent Questions as Millions Take Psychotropic Drugs

- NRx Pharmaceuticals Launches Breakthrough One-Day Treatment Clinic in Florida as FDA Pathway and Clinical Data Strengthen Growth Outlook; $NRXP

- Revenue Optics Launches Talent Infrastructure Platform for SaaS Revenue Hiring and Appoints Sabz Kaur to Lead Growth

- Building a Multi-Domain Autonomous Systems Platform at the Intersection of AI, Defense and Infrastructure: VisionWave Holdings (N A S D A Q: VWAV)

- Bent Danholm Named "Top Luxury Real Estate Leader" in Modern Luxury Miami

- Author Ken Mora to Celebrate New Caravaggio Book Debut with Special Event at Palazzo Venezia Naples

- Matthew Sisneros Releases Raw and Unfiltered Memoir: The Devil Lost Another One — A Powerful Story of Crime, Consequence, and Redemption

- From Life to Light: Jess L. Martinez Shares a Soulful Poetry Collection That Explores What It Means to Be Human

- Lawsuit Filed Against Boeing Over Defective Seat Switch on Boeing 787

- Quadcode Acquires Significant Stake in Game 7, LLC - The Parent Company for FPFX Tech and PropAccount.com

- Danholm Collection Announces Sale of 16689 Broadwater Ave in Winter Garden, Highlighting Strong Performance in Twinwaters Community

- Cleveland County Families Choosing to Restore Quality Furniture Instead of Buying New

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- Raleigh Emerges as a Key Player in Sustainable Fashion Innovation for 2026

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Emperor of the Cherokee: A Novel Debuts