Trending...

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Notice: Hrm Queen Laurence I Assumes Crown Control & $317q Fund. 3bn Unopoly Shares Settled. Requisition Of Buckingham Palace & Windsor Castle Final

VerifyNow launches a comprehensive RegTech platform offering South African businesses instant KYC verification, identity verification, and a free RMCP generator.

JOHANNESBURG - ncarol.com -- VerifyNow Launches Groundbreaking FICA Compliance Platform for South African Businesses

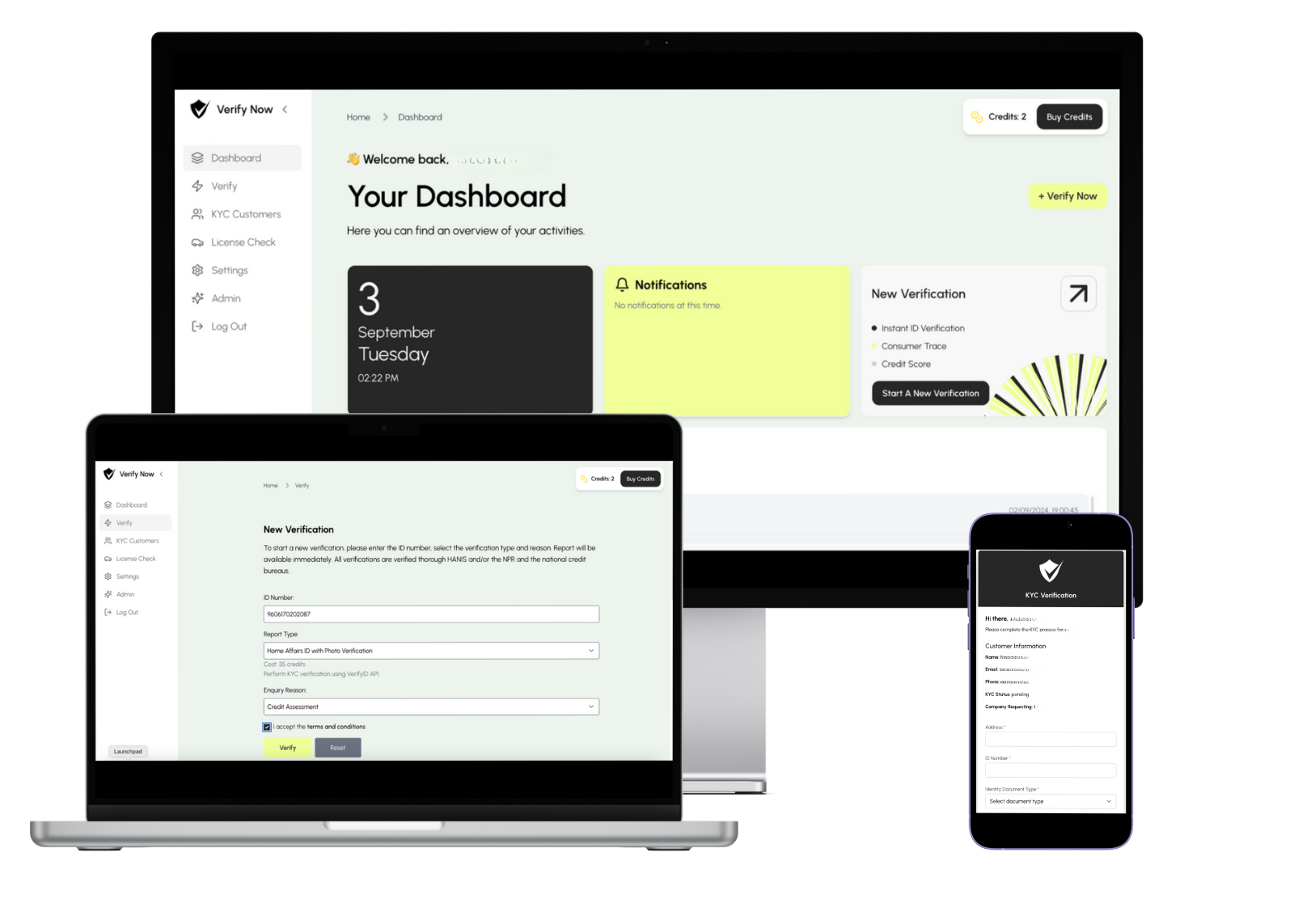

VerifyNow.co.za, a proudly South African company, today announced the launch of its innovative all-in-one dashboard platform that offers FICA compliance tools and instant Know Your Customer (KYC) verification at the click of a button. Designed to cater to businesses of all sizes, the platform aims to simplify compliance processes and protect companies against the rising tide of identity fraud and non-compliance penalties.

According to recent studies, South Africa faces a significant challenge with identity fraud, costing businesses millions of rand each year. Non-compliance with the Financial Intelligence Centre Act (FICA) not only exposes companies to hefty fines but also tarnishes their reputations. VerifyNow addresses these critical issues by providing an easy-to-use platform that streamlines compliance and verification processes.

"Our mission is to empower South African businesses to navigate the complexities of FICA compliance effortlessly," said Ru Foster, CEO of VerifyNow. "We understand the risks that identity fraud and non-compliance pose to companies. Our platform offers a simple, efficient solution that can be tailored to the needs of any business, whether small or large."

More on ncarol.com

The VerifyNow platform features:

Real-World Impact

A recent study by the South African Banking Risk Information Centre (SABRIC) highlights the critical need for robust FICA compliance solutions. In 2024, identity fraud cases in South Africa increased by 22% compared to the previous year, resulting in estimated losses of R4.2 billion to businesses and individuals.

More on ncarol.com

A pilot program conducted with a mid-sized company in Johannesburg demonstrated the effectiveness of VerifyNow's platform. An industry expert commented, "VerifyNow's platform has transformed our compliance processes. We've significantly reduced our risk exposure while freeing up resources to focus on core business activities. It's been a game-changer for us."

Why FICA Compliance Matters

Non-compliance with FICA regulations can result in fines up to R100 million or imprisonment for up to 15 years. With financial crimes on the rise, regulators are enforcing stricter measures to ensure businesses are not inadvertently facilitating illegal activities. VerifyNow's platform assists companies in meeting these obligations efficiently, reducing risk and ensuring peace of mind.

Join the Compliance Revolution

Businesses interested in safeguarding themselves against fraud and non-compliance penalties are encouraged to visit www.verifynow.co.za to learn more about the platform's features and subscription plans.

About VerifyNow

VerifyNow is a Johannesburg-based technology company committed to providing innovative online solutions for FICA compliance and KYC verification. VerifyNow strictly adheres to compliance standards and is fully compliant with the Protection of Personal Information Act (POPIA) and SOC 2® requirements. This ensures that all data handled by the platform is managed securely and ethically, providing peace of mind to businesses and their customers.

Verify Now combines local expertise with advanced technology to serve the needs of businesses across South Africa.

VerifyNow.co.za, a proudly South African company, today announced the launch of its innovative all-in-one dashboard platform that offers FICA compliance tools and instant Know Your Customer (KYC) verification at the click of a button. Designed to cater to businesses of all sizes, the platform aims to simplify compliance processes and protect companies against the rising tide of identity fraud and non-compliance penalties.

According to recent studies, South Africa faces a significant challenge with identity fraud, costing businesses millions of rand each year. Non-compliance with the Financial Intelligence Centre Act (FICA) not only exposes companies to hefty fines but also tarnishes their reputations. VerifyNow addresses these critical issues by providing an easy-to-use platform that streamlines compliance and verification processes.

"Our mission is to empower South African businesses to navigate the complexities of FICA compliance effortlessly," said Ru Foster, CEO of VerifyNow. "We understand the risks that identity fraud and non-compliance pose to companies. Our platform offers a simple, efficient solution that can be tailored to the needs of any business, whether small or large."

More on ncarol.com

- MetalMetric Launches Free Live Precious Metals Melt Value Calculator Suite

- K2 Integrity Enhances Technology Capabilities Through Acquisition of Leviathan Security Group

- #WeAreGreekWarriors Comes to Detroit in Celebration of Women's History Month

- Buildout Launches CRM, Completing the Industry's First AI-Powered End-to-End Deal Engine for CRE

- Energywise Solutions and Pickleball Pros Partner to Bring More Energy and Visibility to Pickleball Clubs

The VerifyNow platform features:

- Identity Verification: Quickly confirm customer identities with ID and photo directly from the Department of Home Affairs to prevent fraud.

- Easy KYC - Automated Customer onboarding and KYC verification.

- KYC/AML/PEP Adverse Reports Compliance: Ensure adherence to Know Your Customer (KYC), Anti-Money Laundering (AML), and Politically Exposed Persons (PEP) regulations.

- Credit Risk Scores - Obtain swift credit scores with risk levels.

- Driver's License Checks - Instant Driver's License verification

- Customer Tracing: Detailed contact tracing including employment, addresses and phone numbers. Identify all ID numbers linked to a phone number for thorough FICA checks.

- Free Risk Management and Compliance Programme (RMCP) Generator: Create customized RMCPs to meet FICA requirements without additional costs.

- FICA Compliance Toolkit: Access a collection of free training resources and tools designed to simplify FICA compliance.

- User-Friendly Dashboard: Manage all compliance activities from a single, intuitive interface.

- Scalable Plans: Flexible subscription models suitable for startups to large enterprises.

- Secure Data Handling: Advanced encryption and security protocols to protect sensitive information.

Real-World Impact

A recent study by the South African Banking Risk Information Centre (SABRIC) highlights the critical need for robust FICA compliance solutions. In 2024, identity fraud cases in South Africa increased by 22% compared to the previous year, resulting in estimated losses of R4.2 billion to businesses and individuals.

More on ncarol.com

- The Franchise King® Releases Free Guide for Nervous Buyers

- Kanguro Insurance Taps Paylode to Launch Best-in-Class Pet and Renters Insurance Rewards Experience

- CCHR: CIA Mind-Control Files Raise Urgent Questions as Millions Take Psychotropic Drugs

- NRx Pharmaceuticals Launches Breakthrough One-Day Treatment Clinic in Florida as FDA Pathway and Clinical Data Strengthen Growth Outlook; $NRXP

- Revenue Optics Launches Talent Infrastructure Platform for SaaS Revenue Hiring and Appoints Sabz Kaur to Lead Growth

A pilot program conducted with a mid-sized company in Johannesburg demonstrated the effectiveness of VerifyNow's platform. An industry expert commented, "VerifyNow's platform has transformed our compliance processes. We've significantly reduced our risk exposure while freeing up resources to focus on core business activities. It's been a game-changer for us."

Why FICA Compliance Matters

Non-compliance with FICA regulations can result in fines up to R100 million or imprisonment for up to 15 years. With financial crimes on the rise, regulators are enforcing stricter measures to ensure businesses are not inadvertently facilitating illegal activities. VerifyNow's platform assists companies in meeting these obligations efficiently, reducing risk and ensuring peace of mind.

Join the Compliance Revolution

Businesses interested in safeguarding themselves against fraud and non-compliance penalties are encouraged to visit www.verifynow.co.za to learn more about the platform's features and subscription plans.

About VerifyNow

VerifyNow is a Johannesburg-based technology company committed to providing innovative online solutions for FICA compliance and KYC verification. VerifyNow strictly adheres to compliance standards and is fully compliant with the Protection of Personal Information Act (POPIA) and SOC 2® requirements. This ensures that all data handled by the platform is managed securely and ethically, providing peace of mind to businesses and their customers.

Verify Now combines local expertise with advanced technology to serve the needs of businesses across South Africa.

Source: Verify Now

Filed Under: Business

0 Comments

Latest on ncarol.com

- 13 Full Moons of Black Dandelion Convergent Voice™ An Integration of Literacy & Wellness Symposium

- Emperor of the Cherokee: A Novel Debuts

- Yoga Retreats, Ecstatic Dance & Spiritual App launched

- Legendary broadcaster & cultural influencer Beatrice Thompson sat down with hosts of The Game Has E

- Elder Abuse Case Against Healthy Traditions Owner Raises Questions As To The Dire Reality Of Abuse Against The Last Of The Baby Boomers

- Simpalm Staffing Services Launched its Refreshed Website for Remote Staffing Services

- Claude Riveloux Review 2026: How the $10B Fund Manager Dispels 'Scam' Rumors Through Education

- Pure Energy Electrical Services, LLC Announces Strong Start to 2026, Reinforcing Customer-First Electrical Service Across Northeast Florida

- Danholm Collection Launches Boutique Luxury Real Estate Brokerage in Central Florida

- Sellvia Market Expands Curated Store Portfolio for Dropshipping Sellers

- Food Journal Magazine Raises the Standard for Restaurant Reviews in Los Angeles

- Call for Nominations for the 2027 Paul E Garber First Flight Shrine

- Williamsville Spa Expands Team to Meet Growing Demand for Professional Facials

- Pregis Expands Wind Energy Use, Advancing Progress Toward Net Zero by 2040

- Dr. Sheel Desai Solomon and Preston Dermatology Continue Awards Streak with Top Honors in 2026 Maggy Awards

- Jack and Sage Acquires Sustainable Apparel Brand Kastlfel, Expanding Premium Logo Wear Across National Parks and Ski Resorts

- Cancun International Airport Prepares for Record Travel Surge Ahead of Spring Break, Summer, and the 2026 High Season

- $167 Billion Pharma R&D Market Largely Untapped by AI Creates Major Growth Runway for KALA Bios Data-Sovereign AI Strategy: N A S D A Q: KALA

- Lighthouse Tech Awards Recognize Top HR Technology Providers for 2026

- ADB Selects OneVizion to Advance Field Execution and Infrastructure Program Management