Trending...

- Purple Heart Recipient Honored by Hall of Fame Son In Viral Tribute Sparking National Conversation on Service Fatherhood, Healing and Legacy

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- VENUS Goes Live on CATEX Exchange As UK Financial Ltd Activates The Premier Division Of The Maya Meme's League

One of the Nation's Largest Pre-Owned Boat Dealers Targets Expansion, Technology Leadership, and Luxury Brokerage Growth. OTH Has Locations in Multiple States Including Newest in Florida to Serve as Headquarters for Luxury Brokerage Division

WILMINGTON, N.C. - ncarol.com -- The U.S. marine industry—valued at more than $57 billion—is entering a period of sustained growth, and Off The Hook YS Inc. (NYSE American: OTH) is positioning itself as a major beneficiary. Founded in 2012 and now one of the largest buyers and sellers of pre-owned boats in the country, OTH has built a scalable, tech-enabled platform aimed at modernizing an industry ripe for disruption.

With a national footprint, expanding luxury brokerage operations, strong technology adoption, and a fresh infusion of capital from its November 2025 IPO, OTH is targeting accelerated growth in one of America's most resilient recreation markets.

A National Marine Powerhouse Built on Speed, Scale, and Technology

From its headquarters in Wilmington, North Carolina, OTH has become a dominant force in the pre-owned boat sector. The company:

As consumer demand continues shifting into digital and hybrid sales environments, OTH's technology-focused model allows customers to buy or sell vessels faster and with clearer pricing than many traditional brokerages.

More on ncarol.com

Expanding Into a $57 Billion U.S. Marine Market—Plus a High-Growth Repair Segment

The broader U.S. marine industry—including boats, yachts, accessories, and services—represents a $57 billion market. OTH is strategically positioned to capture share through wholesale buying, brokerage services, inventory turnover, and premium yacht sales.

Further complementing this opportunity is the rapidly expanding U.S. Ship Repair and Maintenance Services Market, which:

This steady, long-term growth trajectory gives OTH multiple avenues for operational and revenue expansion beyond traditional brokerage.

New Jupiter, Florida Headquarters for Luxury Brokerage Division

On November 25, OTH announced a major milestone: the development of a new office in Jupiter, Florida, which will serve as headquarters for Autograph Yacht Group (AYG)—the company's recently launched luxury brokerage division led by industry veteran Mike Burke.

The Jupiter location includes:

The facility sits in one of the most active yachting corridors in the United States, giving AYG immediate access to a high-value customer base.

"We expect the build-out of this location to be completed and move-in ready in the beginning of 2026," said Brian S. John, CEO of OTH. "The location will also have six boat slips for some of our best inventory."

The expansion represents a critical step in OTH's long-term strategy to build a luxury-focused, nationally recognized yacht brokerage brand.

More on ncarol.com

Successful Initial Public Offering Raises $15 Million

On November 14, Off The Hook YS Inc. closed its initial public offering of 3,750,000 shares of common stock at $4.00 per share, generating $15 million in gross proceeds before underwriting fees and expenses. The underwriters were also granted a 45-day option to purchase an additional 562,500 shares to cover over-allotments.

Use of proceeds includes:

ThinkEquity served as sole book-running manager for the transaction.

The successful IPO gives OTH the capital flexibility to scale inventory, expand locations, invest in technology, and accelerate growth through 2025 and beyond.

A Company Positioned for Strong Long-Term Growth

With a proven acquisition engine, expanding national footprint, strong leadership team, and a differentiated technology platform, Off The Hook YS Inc. is emerging as a key consolidator in a fragmented market.

The company is now strategically aligned to capitalize on:

For investors seeking a company with both established scale and high-growth potential, OTH represents an emerging opportunity at the intersection of recreation, technology, and marine services.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Media Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Websites:

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a national footprint, expanding luxury brokerage operations, strong technology adoption, and a fresh infusion of capital from its November 2025 IPO, OTH is targeting accelerated growth in one of America's most resilient recreation markets.

A National Marine Powerhouse Built on Speed, Scale, and Technology

From its headquarters in Wilmington, North Carolina, OTH has become a dominant force in the pre-owned boat sector. The company:

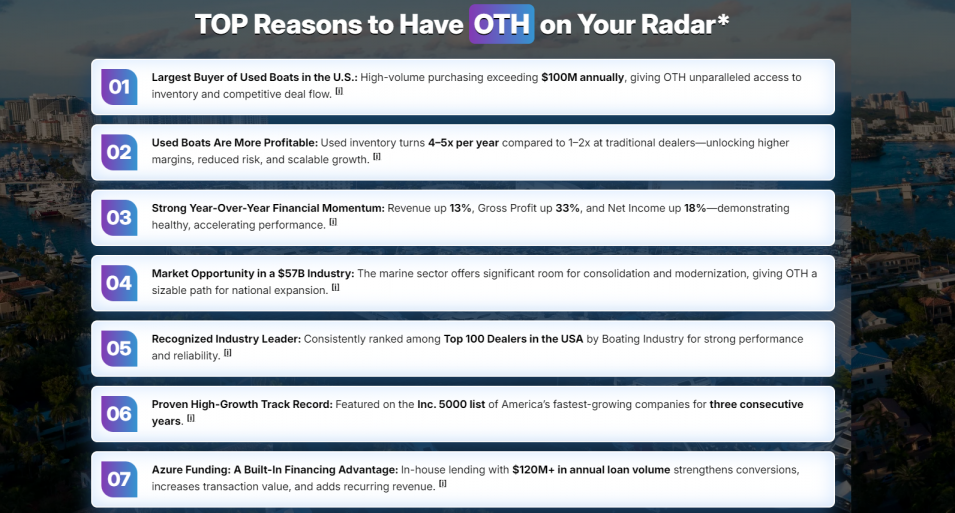

- Acquires more than $100 million annually in boats and yachts

- Operates a nationwide network of offices and marinas across multiple states

- Leverages AI-assisted valuation tools and a data-driven sales platform to bring speed, accuracy, and transparency to transactions

- Has been repeatedly recognized by the Inc. 500 and ranked among the Top 100 Dealers in the USA

As consumer demand continues shifting into digital and hybrid sales environments, OTH's technology-focused model allows customers to buy or sell vessels faster and with clearer pricing than many traditional brokerages.

More on ncarol.com

- National Expansion Ignited Across Amazon $AMZN, Chewy $CHWY & Walmart $WMT: NDT Pharmaceuticals, Inc. (Stock Symbol: NDTP) $NDTP

- Distributed Social Media - Own Your Content

- Tarrytown Expocare Pharmacy Announces Strategic Leadership Appointments to Accelerate Growth and Innovation

- New Environmental Thriller "The Star Thrower" Reimagines a Classic Lesson in Individual Impact

- Summit Appoints Javier Cabeza as Data, AI, and Analytics Practice Lead

Expanding Into a $57 Billion U.S. Marine Market—Plus a High-Growth Repair Segment

The broader U.S. marine industry—including boats, yachts, accessories, and services—represents a $57 billion market. OTH is strategically positioned to capture share through wholesale buying, brokerage services, inventory turnover, and premium yacht sales.

Further complementing this opportunity is the rapidly expanding U.S. Ship Repair and Maintenance Services Market, which:

- Is valued at $6.55 billion in 2025

- Is projected to reach $11.72 billion by 2033

- Is growing at a 7.52% CAGR

This steady, long-term growth trajectory gives OTH multiple avenues for operational and revenue expansion beyond traditional brokerage.

New Jupiter, Florida Headquarters for Luxury Brokerage Division

On November 25, OTH announced a major milestone: the development of a new office in Jupiter, Florida, which will serve as headquarters for Autograph Yacht Group (AYG)—the company's recently launched luxury brokerage division led by industry veteran Mike Burke.

The Jupiter location includes:

- Newly built office space

- Six dedicated boat slips for high-end inventory

- Space to house members of OTH's Florida-based C-suite

The facility sits in one of the most active yachting corridors in the United States, giving AYG immediate access to a high-value customer base.

"We expect the build-out of this location to be completed and move-in ready in the beginning of 2026," said Brian S. John, CEO of OTH. "The location will also have six boat slips for some of our best inventory."

The expansion represents a critical step in OTH's long-term strategy to build a luxury-focused, nationally recognized yacht brokerage brand.

More on ncarol.com

- Interview: Why I Sponsored Carson Ware - The Full Story

- March Is Skiing's Smartest Buying Window

- Zeo Health Introduces KidZ Cleanse with Folinic Acid

- Cancun Airport Transportation Expands Fleet Ahead of Record Passenger Growth at Cancun International Airport

- Tobu Group's "T-home Series" of Accommodations in Tokyo Just Opened "T-home KEI."

Successful Initial Public Offering Raises $15 Million

On November 14, Off The Hook YS Inc. closed its initial public offering of 3,750,000 shares of common stock at $4.00 per share, generating $15 million in gross proceeds before underwriting fees and expenses. The underwriters were also granted a 45-day option to purchase an additional 562,500 shares to cover over-allotments.

Use of proceeds includes:

- Servicing its floorplan

- Enhanced marketing and advertising efforts

- Repayment of a promissory note

- General working capital

ThinkEquity served as sole book-running manager for the transaction.

The successful IPO gives OTH the capital flexibility to scale inventory, expand locations, invest in technology, and accelerate growth through 2025 and beyond.

A Company Positioned for Strong Long-Term Growth

With a proven acquisition engine, expanding national footprint, strong leadership team, and a differentiated technology platform, Off The Hook YS Inc. is emerging as a key consolidator in a fragmented market.

The company is now strategically aligned to capitalize on:

- A massive and growing U.S. marine economy

- Continued consumer demand for pre-owned boats and luxury yachts

- Digital transformation within the brokerage sector

- Rising demand in the marine repair and maintenance industry

- Expansion into high-value boating markets like Florida

For investors seeking a company with both established scale and high-growth potential, OTH represents an emerging opportunity at the intersection of recreation, technology, and marine services.

For More Information

Company: Off The Hook YS Inc. (N Y S E American: OTH)

Media Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Websites:

- www.offthehookyachts.com

- https://compasslivemedia.com/oth/

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on ncarol.com

- Primeindexer Google indexing platform launched by SEO Danmark APS

- Kaltra Introduces New Downward-Spraying Distribution Technology to Boost Microchannel Evaporator Performance

- Talentica Announces Winners of Multi-Agent Hackathon 2026

- Special Alert: Undervalued Opportunity: IQSTEL (N A S D A Q: IQST) Positioned for Explosive Multi-Year Growth

- Triple-Digit Growth, Strategic N A S D A Q Uplist, Plus A Scalable Healthcare Rollout Model: Stock Symbol: CDIX

- Vesica Health Receives FDA Breakthrough Device Designation for AssureMDx

- Lineus Medical's SafeBreak® Vascular Added to Alliant GPO Contract

- Cancun All Inclusive is ready for Spring Break 2026 with new Resorts, Exclusive Deals, activities and more!

- 66% of US Bankruptcies Are Medical — So Americans Are Building Businesses That Cover Healthcare Emergencies

- Husband and Wife Release Children's Book and Donate Proceeds to Non-Profit

- Ludex Partners With Certified Trading Card Association (CTCA) To Elevate Standards And Innovation In The Trading Card Industry

- Best Book Publishing Company for Aspiring Authors

- Dr. Nadene Rose Releases Moving Memoir on Faith, Grief, and Divine Presence

- Gigasoft Solves AI's Biggest Charting Code Problem: Hallucinated Property Names

- AKG To Demonstrate New Digital E-catalog Experience Daily At CONEXPO CON/AGG 2026

- ASTI Ignites the Space Economy: Powering SpaceX's NOVI AI Pathfinder with Breakthrough Solar Technology: Ascent Solar Technologies (N A S D A Q: ASTI)

- STEM For Kids Launches Root Protocol™: A Human Bridge for Gen Alpha's Digital Curiosity Crisis

- Hiring has reached a "Digital Stalemate"—Now, an ex-Google recruiter is giving candidates the answers

- 2026 Pre-Season Testing Confirms a Two-Tier Grid as Energy Management Defines Formula 1's New Era

- Platinum Car Audio LLC Focuses on Customer-Driven Vehicle Audio and Electronics Solutions